The current state:

Vibecession is a term widely used to describe a period during which the economy is relatively good according to financial data, but the public is pessimistic about the current or future economic situation. With consumer spending accounting for two-thirds of the U.S. economy, how we feel about the current economic situation is often more influential on spending than the actual economic reality.

How we’re feeling right now:

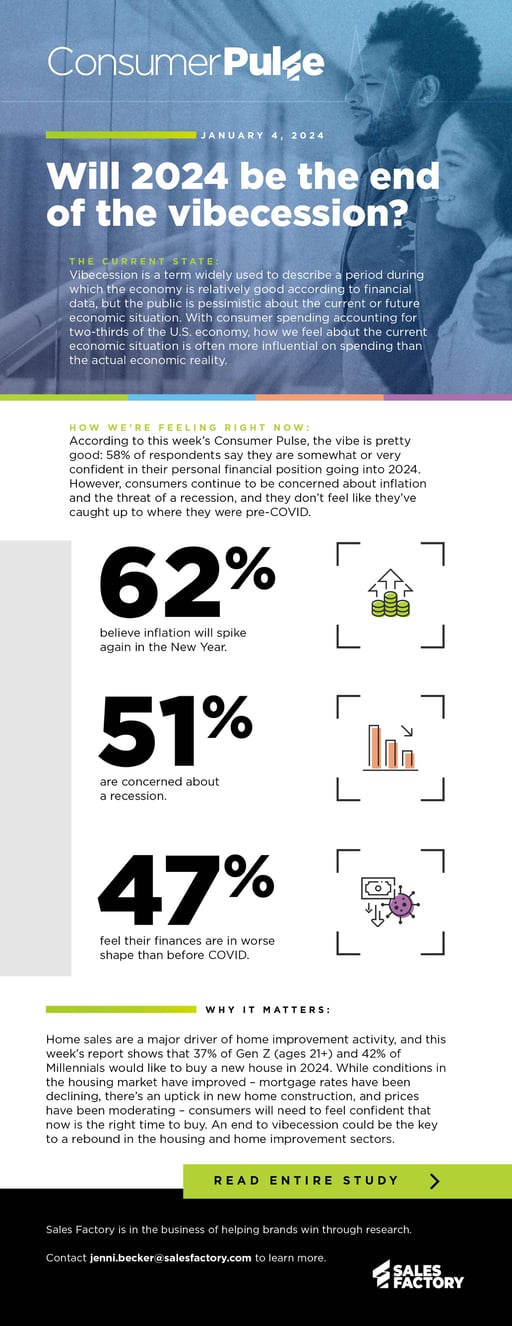

According to this week’s Consumer Pulse, the vibe is pretty good: 58% of respondents say they are somewhat or very confident in their personal financial position going into 2024. However, consumers continue to be concerned about inflation and the threat of a recession, and they don’t feel like they’ve caught up to where they were pre-COVID.

• 62% believe inflation will spike again in the New Year.

• 51% are concerned about a recession.

• 47% feel their finances are in worse shape than before COVID.

Why it matters:

Home sales are a major driver of home improvement activity, and this week’s report shows that 37% of Gen Z (ages 21+) and 42% of Millennials would like to buy a new house in 2024. While conditions in the housing market have improved – mortgage rates have been declining, there’s an uptick in new home construction, and prices have been moderating – consumers will need to feel confident that now is the right time to buy. An end to vibecession could be the key to a rebound in the housing and home improvement sectors.

Do you want to take the Pulse of your customers? Our Insights team will partner with you to design a study that will help you better understand your customers and their problems, and how your brand can win at retail.

To get additional insight into what this means for brands and retailers, read the entire study.

Like what you're reading?